Take a look at the home screen of an average smartphone today. Somewhere between the social apps and the streaming platforms, there’s almost always one for money. Cash App, Venmo, Robinhood. These aren’t just tools anymore. They’ve become part of how people live, spend, save, and invest.

The way people interact with their finances has changed, and it’s changed fast. Fintech apps are no longer considered alternatives to banks. For millions, they are the primary way they handle money. And that didn’t happen by accident.

These apps are built with intention.

They combine simplicity with security, accessibility with compliance, and they understand the difference between offering a feature and solving a problem.

If you’re planning to build a fintech product, these are the players worth studying. Not to imitate, but to understand. Because the next great app won’t look exactly like Cash App. It will take the same principles and apply them in a way that speaks to a new kind of user or solves a gap the others haven’t addressed.

In this guide, we’ll take a closer look at what makes leading fintech apps successful in the US market. We’ll break down the product strategies, the technology choices, and the development decisions that helped them scale. You’ll also get a clear view of how working with a fintech app development company can shape your own path, whether you’re launching your first MVP or building something more ambitious.

Fintech is one of the most demanding and rewarding spaces in app development. Understanding how the best got there is the first step toward building something that belongs in that conversation.

The first thing you notice is how little there is to notice

Cash App doesn’t try to dazzle. It doesn’t need to. The home screen is clean. A balance at the top. A few icons. Send. Request. Nothing extra.

This is intentional. Every tap feels obvious. Every step, minimal.

That sense of effortlessness isn’t easy to create. It comes from knowing exactly what the user wants the moment they open the app and removing everything that gets in the way.

It started with peer-to-peer payments. Now, Cash App handles direct deposit, stock trading, Bitcoin, even tax filing. But it never feels like a bundle of features.

The app unfolds gradually. A user might start by paying a friend. A few weeks later, they try direct deposit. Then a card arrives in the mail. It builds, piece by piece, without ever forcing anything.

This kind of growth feels natural. More importantly, it respects attention. It lets people discover value on their own terms.

Compliance is built in. Identity checks happen behind the scenes. Payments go through quickly. Nothing breaks the flow.

The app earns trust by not asking for it all at once.

For any fintech product, this is where technical decisions matter. A smooth interface means nothing if identity verification or transaction handling slows users down. The infrastructure behind Cash App works quietly, but relentlessly, to keep things moving.

Cash App didn’t win by offering everything. It won by doing a few things incredibly well.

It chose simplicity over features. Timing over pressure. Function over flash.

If you’re building a financial product, that approach still applies. Start with clarity. Build what people actually need. Let adoption grow through experience, not instruction.

And make sure your development team knows how to deliver that kind of simplicity. Because it’s not simple to build.

A social experience wrapped in finance

Venmo didn’t just make it easy to send money. It made it something people wanted to do.

The core product is simple: peer-to-peer transfers. But what set Venmo apart was the way it turned transactions into a shared experience. Every payment has a message, a moment, or a story attached. And while it might seem like a novelty at first, that social layer did something powerful. It made people open the app even when they weren’t sending money.

Most financial apps are utilities. Venmo added behavior. That’s a different kind of value.

Venmo’s design encourages interaction. The feed shows who paid whom and why. Emojis, comments, inside jokes, all of it contributes to stickiness. And with every shared transaction, the product becomes a little more familiar, a little more viral.

This isn’t just clever UI. It’s user retention built into the interface.

For anyone working with a fintech app development company, this is a lesson worth paying attention to. Building functionality is one thing. Building behavior is something else entirely.

Venmo’s backend is designed for speed. The money moves quickly, but more importantly, it feels instant. There’s no hesitation between sending and confirmation. No questions about whether it went through.

This kind of responsiveness depends on thoughtful development. Choosing the right infrastructure. Handling scale. Minimizing latency. These are the kinds of decisions that define a well-executed fintech product and they’re exactly where the right fintech app development services come in.

A strong mobile app development company knows how to build for immediacy. Not just technical performance, but emotional responsiveness too. That’s what keeps users coming back.

Venmo shows that a payment app doesn’t have to feel transactional. It can be conversational. It can be fun. It can even be part of someone’s social routine.

That doesn’t mean every fintech app needs a feed or emojis. But it does mean that human behavior matters just as much as technical capability.

If you’re planning to launch or evolve a fintech product, especially in the US market, pay close attention to how Venmo became more than a utility. Then look for a development partner who can build with both users and systems in mind.

Lowering the barrier without lowering the bar

Before Robinhood, investing wasn’t inaccessible because of fees. It was inaccessible because it felt foreign. Account minimums, complex tools, financial jargon — all signals that it wasn’t built for beginners.

Robinhood understood that the real blocker was confidence. The product didn’t just remove costs. It removed hesitation.

The result was an app that felt usable from the first tap.

Robinhood doesn’t explain everything up front. It guides users as they explore. Tap a stock, get a chart. Tap again, see more data. Simple steps, each building comfort.

This kind of progression isn’t accidental. It’s good product thinking. Enough structure to feel safe, enough freedom to stay curious.

For teams working with a fintech app development company, this is where product and UX alignment matter. You’re not just building features. You’re building understanding.

As Robinhood grew, speed and reliability became non-negotiable. Real-time trading, high traffic, regulatory scrutiny, everything had to hold under pressure.

That’s where technical architecture matters. A mobile app development company building for fintech needs to solve for scale from day one. Uptime, data flow, user protection — none of it can be patched in later.

Robinhood didn’t simplify investing by dumbing it down. It did it by making the experience less intimidating and more rewarding.

That shift came from thoughtful execution, not surface design.

If you’re building something that opens up access, whether to investing, credit, or personal finance, this is the model to learn from.

Work with fintech app development services that understand both sides of the product. The surface, and the structure underneath that makes it possible.

The most successful fintech products don’t compete on features.

They win by understanding behavior — and designing around it.

Here’s what they consistently get right.

Financial products can be intimidating.

The best ones avoid that by making everything feel familiar.

This isn’t about dumbing things down.

It’s about respecting people’s time and attention.

Security isn’t a feature. It’s an expectation.

What builds real trust is consistency.

Reliability is part of the user experience.

If it doesn’t work right, nothing else matters.

Every added function needs to justify its place.

That’s how these apps avoid bloat and stay focused.

Think of it this way:

This kind of restraint only works when the product is planned well from the start.

That’s where a fintech app development company becomes essential.

You need people who know when to build and when not to.

None of these platforms scaled by accident.

Every feature drove engagement. Every decision made returning feel natural.

And they all worked because the product supported it under the hood.

That’s what great fintech app development services provide: structure, not just speed.

| Launch Strategy | Poor Execution Example | Better Practice Used by Top Apps |

|---|---|---|

| Feature Rollout | Release 5 tools at once with no context | Introduce features based on user behavior |

| Onboarding | Long tutorials, complex forms | Minimal steps, in-context guidance |

| Trust Building | Explain security in a help doc | Show reliability through performance |

| Product Expansion | Add features users didn’t ask for | Evolve based on usage and feedback |

Building a fintech app today means more than just offering digital payments or a sleek UI.

You’re stepping into a space where trust, speed, and compliance are expected from day one.

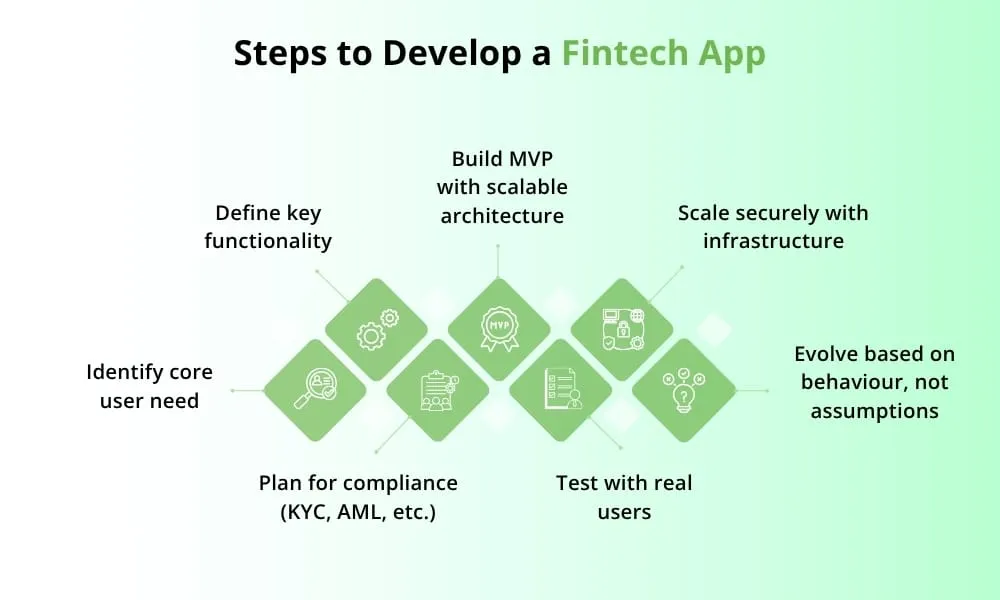

So how do you build something that belongs?

Too many apps chase functionality before understanding the real need.

Ask better questions:

Features come later. Behavior comes first.

If you’re targeting the US market, regulation is not something to retrofit.

KYC, AML, fraud prevention, data security — these aren’t checkboxes.

They shape how your app is built, stored, and maintained.

A fintech app development company with US-market experience will factor this into the architecture from the beginning.

It saves time. It protects your users.

And it makes sure your app doesn’t get stuck in review.

Your MVP might work for 1,000 users.

That doesn’t mean it will hold at 100,000.

Speed, uptime, data flow — these affect trust as much as design does.

Partnering with a mobile app development company that understands fintech means planning for scale on day one, not reacting to failure later.

It’s the difference between growing and glitching.

The best fintech apps in the US didn’t just launch with a good idea.

They launched with infrastructure, clarity, and a product that felt personal.

You don’t need to build the next Robinhood or Cash App.

But you do need to build something that feels just as intentional.

And that starts with the right people.

You can have a great idea.

You can have a clear vision.

But if you choose the wrong team to build it, none of that matters.

The partner you work with isn’t just writing code.

They’re shaping your product, your speed to market, and how people experience money through your app.

You don’t need just any mobile app development company.

You need one that knows fintech and knows the market.

Here’s what to look for:

In other industries, a bug is a nuisance.

In fintech, it’s a loss of trust. Sometimes even a violation of law.

Your app needs to work. Securely. Smoothly. Predictably.

And it needs to feel good doing it.

That’s not something you leave to chance.

Working with fintech app development services that understand this world means fewer compromises, better decisions, and a stronger product, from the first line of code to the first real customer.

The most trusted fintech apps in the US didn’t succeed because they were first. They succeeded because they were focused. Thoughtfully designed. Built to last. They solved real problems with real clarity. And they worked from the first interaction.

That kind of product doesn’t come from rushing features or cutting corners. It comes from planning well, understanding the user, and building with experience.

If you’re ready to create something of your own, start by choosing the right team. One that knows how to design for trust, scale for growth, and build for how people actually use money. Because in fintech, the idea gets you started but execution is what keeps you in the game.

In this episode, we break down what makes leading fintech apps like Cash App, Venmo, and Robinhood so effective. From clean UX to hidden infrastructure, discover how top apps blend simplicity, trust, and innovation. If you’re building a fintech product, this is your blueprint for success in the US market.

We work with teams who want more than just code who care about product quality, user experience, and building something that lasts.

If that sounds like you, let’s talk.

Start with the right fintech app development company.

We’re ready when you are. Get in touch today.

Are You Prepared for Digital Transformation?

Mobile App Development

Looking for profitable mobile app ideas for startups in 2026? Explore trending ideas and hire expert mobile app development services in the USA.

Mobile App Development

How much does Flutter app development cost in the USA in 2026? See real price ranges, app category costs, and US pricing for startups and enterprises.

Mobile App Development

Planning to hire Android developers? This guide covers costs, skills, hiring models, and common mistakes to help you build apps that last.