If your fintech app isn’t evolving, it’s falling behind.

A few years ago, launching a mobile app was enough to impress investors and attract users. Now? Users expect more than convenience. They expect intelligence. Real-time fraud alerts. Smarter investment insights. Customer service that actually helps without putting them on hold. That’s not future talk. That’s already happening and AI in fintech is driving it.

Some of the most successful companies in the US fintech space aren’t just adding features. They’re turning data into action. Replacing manual workflows with machine precision. Building trust through automation. That kind of innovation isn’t coming from off-the-shelf software. It’s being built through smart, forward-thinking fintech app development.

The problem? Most apps aren’t there yet. And that’s your window.

This isn’t about gimmicks. It’s about working with a Mobile App Development Company that understands how to turn AI into actual business value. A partner that offers Mobile App Development Services purpose-built for financial innovation, not just code and UI, but intelligent systems that adapt, respond, and grow with your users.

Let’s look at what today’s smartest fintech apps are already doing with AI and what your app could be doing better.

The US fintech market isn’t forgiving. Users expect seamless experiences. Investors expect scale. Regulators expect precision. And they all expect it now.

AI is no longer a differentiator. It’s the baseline.

From real-time fraud prevention to smarter credit models, AI in fintech is driving outcomes that were simply impossible with rule-based logic and traditional development methods. Apps that use AI aren’t just more efficient, they’re more trusted, more personalized, and more profitable.

Fintech users don’t care what’s happening in the backend. But they notice when an app feels smarter, when it warns them about fraud before it happens, when it answers their question without waiting on hold, when it offers a loan that a bank would’ve rejected.

These aren’t gimmicks. They’re what AI makes possible when baked into your product from day one. And to make that happen, you need more than just developers. You need a Mobile App Development Company that understands fintech app development at a strategic level — one that’s not just building what you ask for, but what your product needs to compete and lead.

Plenty of apps have clean designs and basic functionality. But the ones leading the market today? They’ve embedded intelligence into every touchpoint.

If your app isn’t doing that, it’s time to rethink what you’re building and who’s building it.

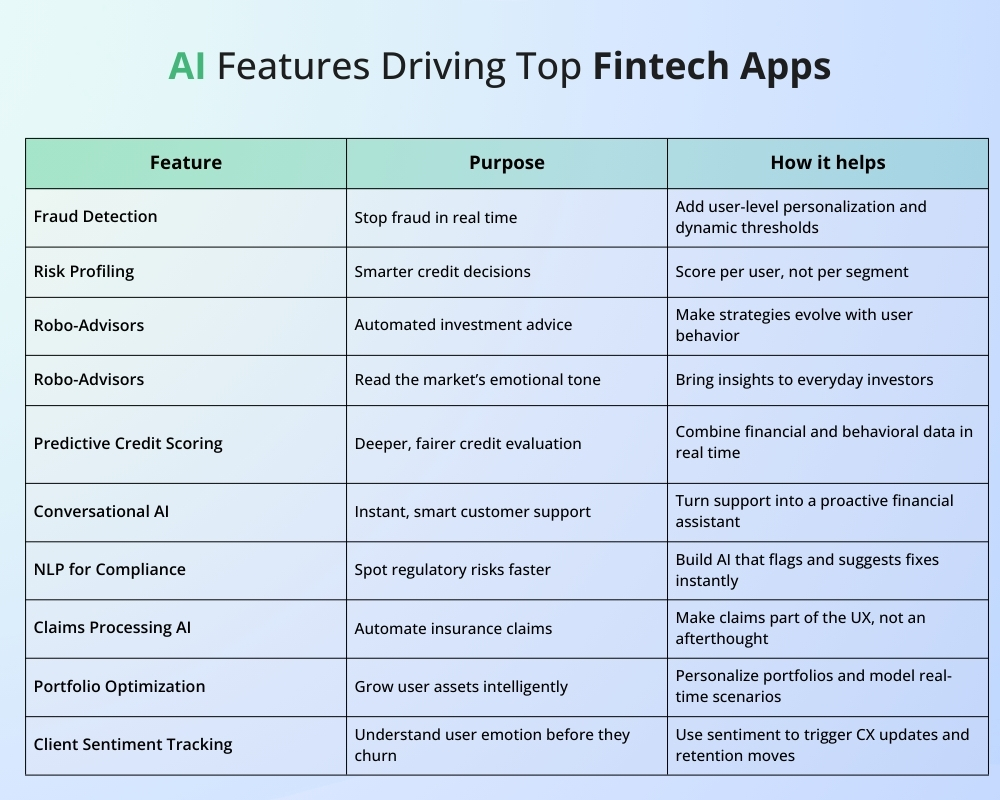

Let’s break down the 10 AI capabilities that are giving fintech apps in the US a real competitive edge.

If your app isn’t catching fraud in real time, someone else’s is

They’ve already replaced old-school rules with AI that learns how users behave. It watches for odd patterns, subtle shifts, and suspicious behavior as it happens. No waiting. No manual reviews. Just smart protection that runs in the background and gets sharper over time.

Still relying on fixed fraud logic or alerts after the fact? That’s not protection, it’s damage control. And users notice. If your app feels slow to respond or falsely flags legit transactions, they won’t stick around.

Fraud detection that actually thinks. Not just reacts. You need real-time analysis, risk scoring, and decisioning that adapts as patterns shift. Big players like Revolut are already doing this well — their system detects fraud based on behavior, device fingerprints, even time-of-day patterns. That’s the bar.

But where you can go further is personalization. Instead of one-size-fits-all thresholds, imagine a fraud engine that adapts to individual trust levels, flags based on intent signals, and improves with every user interaction. That’s not just defense, that’s your edge. And it takes a Mobile App Development Company that knows how to engineer AI into the DNA of real fintech app development, not just bolt it on.

If your app treats every borrower the same, you're leaving money on the table

They’re using AI to build dynamic risk profiles based on behavior, not just credit history. Every tap, payment pattern, spending habit, and income signal feeds into smarter lending decisions. That means better offers for good borrowers and fewer bad loans slipping through.

If your app only looks at credit scores or bank statements, you’re not getting the full picture. You’re either saying no to users you should say yes to or saying yes to the wrong ones. Neither ends well.

A risk engine that learns from data you already have. One that adjusts in real time and gets sharper with every interaction. Every user denied without explanation is a trust problem. Every generic interest rate is a missed opportunity. AI fixes both. It helps you deliver credit decisions that feel smart, fair, and personal — not vague or mechanical. And that’s exactly what the right Mobile App Development Company brings to the table when they actually understand how to apply AI in fintech.

People aren’t looking for more options. They’re looking for better decisions

They’re giving users automated, intelligent guidance based on real goals — not just showing charts and hoping for the best. These apps help users invest with confidence, using AI to build and adjust portfolios without requiring human advisors or hand-holding.

If your app simply tracks investments or shows performance, you’re only doing half the job. Users expect help making decisions. If they can’t get that from you, they’ll move to a platform that offers it.

A built-in advisor that actually feels like it understands the user. Something that adapts to their risk tolerance, timelines, and behavior over time. This is where working with a Mobile App Development Company that understands how to embed decision intelligence into fintech app development pays off, not just in features, but in user loyalty.

Markets don’t move on facts alone. They move on emotion

They’re using natural language processing to scan news, tweets, headlines, and analyst chatter in real time. Not just pulling in data feeds, but reading the mood of the market as it shifts. That means giving users insight into how fear, hype, or optimism is influencing prices — before the charts even react.

If your app only shows past performance or live prices, you’re behind the curve. Traders and investors want a pulse check. They want to know why the market’s moving, not just that it is. Without that, you’re offering information, not intelligence.

A system that interprets tone, language, and trends across global news sources and makes that insight usable for everyday users. We’ve helped fintech clients build exactly that, embedding real-time sentiment engines into platforms where context is just as valuable as numbers. That kind of capability doesn’t come out of the box. It comes from a Mobile App Development Company that knows how to turn real-time data into real-world value inside a fintech app development environment.

Creditworthiness is more than a score. AI sees what traditional models miss

They’re moving beyond FICO and into behavioral data, transaction patterns, income volatility, and even how users interact with the app. AI doesn’t just score risk — it predicts it, using hundreds of micro-signals to assess who’s likely to repay and who isn’t.

If your app relies on static credit scores or basic KYC checks, you’re boxed in. You’re excluding users who might be low-risk but thin-file. Worse, you’re approving users who look good on paper but default in practice. That costs you both growth and reliability.

A credit scoring model that adapts in real time, improves as it learns, and unlocks access for the right users without adding risk. We’ve worked with fintech teams to build predictive models that uncover what the credit bureaus can’t. This is the kind of work that separates solid apps from breakthrough products and it starts with the right Mobile App Development Company that knows how to apply AI inside real fintech app development pipelines.

Your users don’t want a chatbot. They want answers that actually help

They’re using AI-powered assistants that go beyond scripted replies. These systems understand intent, context, and even urgency. Whether it’s a blocked card, a missing payment, or a how-do-I-invest question, the response feels fast, human, and useful.

If your support still runs on ticket systems or rigid bot flows, users feel it. Nobody wants to talk to a wall of pre-written options when they have real money on the line. Every frustrating interaction is a reason to leave.

A support experience that feels personal, responds instantly, and gets smarter with every conversation. Platforms like PayPal and Chime have set the bar with AI systems that resolve issues quickly and scale without friction. That’s good but it’s also just the beginning.

Where you level up is in making support part of the product journey, not just a help desk. Imagine an AI that doesn’t just answer questions but offers proactive nudges, explains new features, and understands user behavior well enough to reduce tickets altogether. That’s where we’ve helped clients go — and that’s where the real competitive edge lives.

You need a Mobile App Development Company that doesn’t just implement AI, but knows how to integrate it into the full fintech experience. That’s where smart fintech app development moves from useful to unforgettable.

Compliance isn’t just a checkbox. It’s a constant test

They’re using natural language processing to interpret regulatory updates, scan internal documents, and flag compliance risks before they become liabilities. When laws shift — and they do, often — AI helps translate legal text into actionable tasks, automatically.

If your team is still manually combing through updates from the SEC, CFPB, or state regulators, you’re losing time and increasing your exposure. Delayed updates, missed disclosures, or incomplete logs can cost more than just fines. They cost credibility.

A compliance engine that stays updated on its own. One that scans policy changes, analyzes your app’s workflows, and surfaces issues without needing an audit to find them. Big banks are investing heavily here, but fintechs have the chance to do it leaner and smarter.

We’ve helped fintechs build systems that auto-flag language in user communication or transaction flows that could lead to non-compliance, before it happens. That’s not just legal protection. That’s product maturity. And it only happens when your Mobile App Development Company understands both the language of code and the language of regulation inside real fintech app development.

The claim process is where trust is won or lost

They’re using AI to handle claims from end to end. Document intake, fraud checks, damage assessments, payout calculations — all automated. It’s faster for users, lighter on ops, and dramatically reduces human error.

If your claims process still involves emails, PDFs, or delayed approvals, you’re not just slowing things down — you’re draining user confidence. When people are stressed, they need clarity. If your app can’t give it, they’ll find one that can.

According to EY, 87 percent of insurance customers say their claims experience directly influences whether they stay with a provider. That’s the moment of truth — not the signup, not the premium, but how fast and clearly you respond when it counts.

A claims experience that feels effortless. Upload a photo, describe the incident, get an instant update. No back-and-forth. No confusion. The smartest players are already doing it, but most aren’t doing it well.

We’ve worked with teams to build AI pipelines that assess damage severity, verify documentation, and move claims forward without human review. That’s not just efficiency. That’s experience design. And it’s what a capable Mobile App Development Company brings when they truly understand the operational layers inside modern fintech app development.

Most investment apps help users track performance. Very few help them improve it

They’re using AI to automatically balance risk and return based on user goals, market conditions, and even behavior. These systems don’t just suggest diversification — they actively optimize portfolios as the market moves, without overwhelming the user with complexity.

If your app offers static allocations or generic recommendations, users will outgrow it. And when they do, they’ll take their assets elsewhere. Sophisticated users expect personalized, data-driven strategies. Everyone else appreciates guidance that makes them feel like a smarter investor.

A dynamic portfolio engine that learns from the market and the user. Think scenario modeling, risk-adjusted rebalancing, and smart nudges when it's time to act — all happening behind a clean, simple interface. We’ve helped fintech products move from passive dashboards to active financial tools that actually grow with the user. That’s what keeps assets under management high and churn low.

To build that kind of intelligence, you need a Mobile App Development Company that knows how to turn data science into intuitive, high-performance fintech app development. Not just build it — build it right.

Your users are telling you how they feel. If your app isn’t listening, you’re already behind

They’re using AI to track emotion across support chats, app usage patterns, reviews, and even silence. Not just scanning for keywords, but identifying frustration, confusion, confidence, hesitation — in real time. That intel feeds directly into product decisions, support workflows, and retention strategies.

If you're only looking at NPS or waiting for negative reviews, you're reacting late. Sentiment builds quietly, and by the time it explodes into a complaint or a churned account, you’ve lost the chance to respond.

An invisible feedback loop that runs continuously. One that flags rising tension, identifies drop-off patterns, and helps your team intervene early — whether that’s a support message, a UX tweak, or a personalized push. We’ve helped clients set up sentiment tracking engines that give product teams a sixth sense about what users are feeling before they say it out loud.

That’s the kind of depth that comes from smart fintech app development, not guesswork. And it’s the difference between building an app users like, and building one they won’t leave. You don’t get there without a Mobile App Development Company that knows how to weave emotional intelligence into the stack.

The gap between average and exceptional fintech apps keeps widening. It’s not about who has more features, it’s about who’s using them intelligently.

The leaders in the US fintech space aren’t guessing. They’re leveraging AI to make sharper credit decisions, detect fraud before it happens, optimize portfolios on the fly, and actually understand their users. That’s not hype. That’s execution.

AI in fintech isn’t a trend. It’s how serious companies are solving real problems and scaling faster. And none of it happens by accident. It takes clarity, strategy, and a team that knows how to build products that think for themselves.

If you’re looking at your roadmap and realizing your app isn’t there yet — that’s the opportunity.

Ready to take your fintech app to the next level? Tune in to learn how AI can supercharge everything from fraud detection to personalized investments—making your app smarter and more competitive in 2025!

We’re a Mobile App Development Company built for fintech.

We design and deliver AI-powered platforms that don’t just keep up, they lead.

Whether you’re modernizing your product or building from scratch, our Mobile App Development Services are built around one goal: turning smart ideas into smarter products.

Let’s talk about what’s next in your fintech app development roadmap.

We’re ready when you are.

Are You Prepared for Digital Transformation?

Mobile App Development

Looking for profitable mobile app ideas for startups in 2026? Explore trending ideas and hire expert mobile app development services in the USA.

Mobile App Development

How much does Flutter app development cost in the USA in 2026? See real price ranges, app category costs, and US pricing for startups and enterprises.

Mobile App Development

Planning to hire Android developers? This guide covers costs, skills, hiring models, and common mistakes to help you build apps that last.