- modular, composable services

- real-time data pipelines

- consistent audit trails

- secure identity and onboarding flows

- embedded compliance checks in every workflow

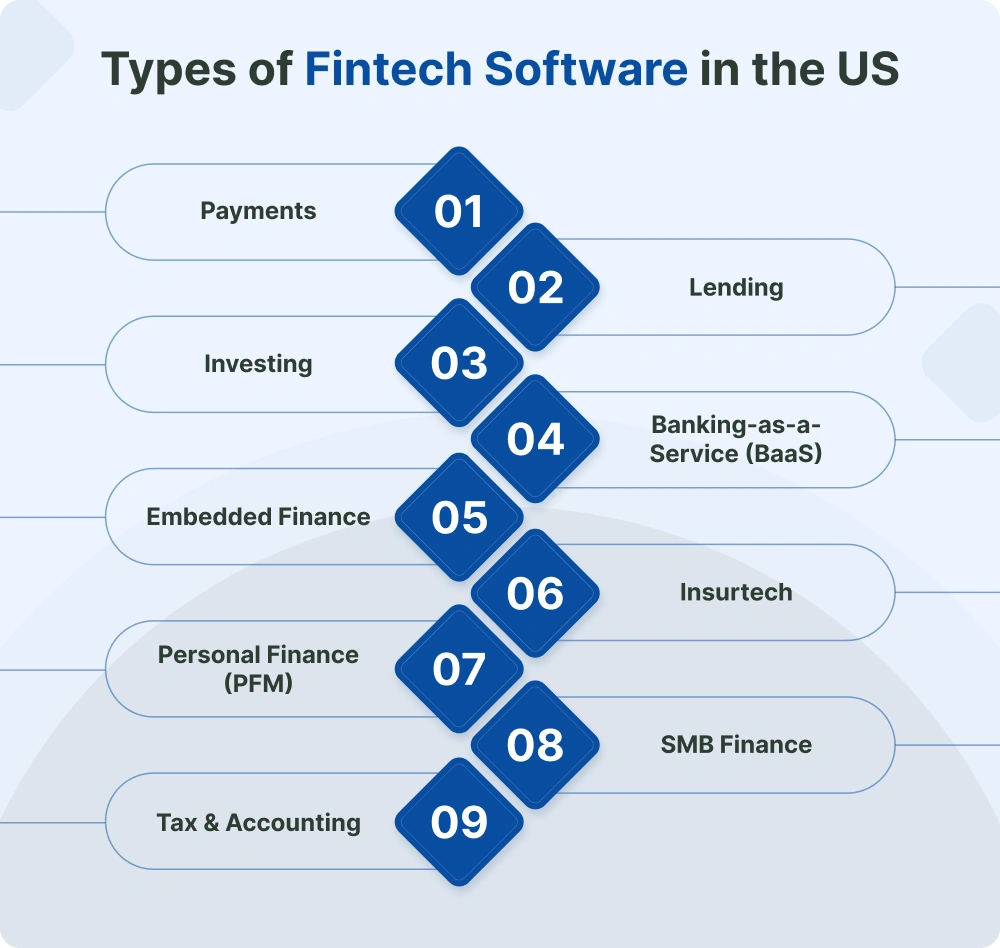

Fintech in the USA is evolving fast. It’s reshaping how money moves, how credit is built, and how financial trust is engineered at scale. The numbers make the shift clear: the U.S. fintech market is projected to grow from roughly $58 billion in 2025 to nearly $119 billion by 2030, a strong 15.4% CAGR.

And the embedded finance segment is expanding just as quickly. Forecasts show it reaching $115.7 billion by 2025, driven by platforms that now treat financial capabilities as part of their core product experience.

In this landscape, building fintech software goes far beyond releasing a polished interface. Teams are architecting systems that stay resilient under regulatory change, integrate with legacy banking rails, process real-time events, and deliver the reliability users expect from the most trusted digital financial products.

This guide breaks down what modern fintech software development in the USA truly looks like from the product categories gaining momentum, to the backend capabilities required to support them, to the architecture patterns shaping high-performing platforms. Whether you’re planning your first release or preparing to scale to millions of users, the sections ahead will help you make sharper technical and product decisions in a market that rewards software built on strong foundations.

Fintech software development in the USA has become a multidisciplinary effort. Product, engineering, compliance, risk, and data teams all contribute to a system that has to communicate clearly, behave reliably, and meet some of the highest expectations in the digital world. The work goes far deeper than screens or feature design, it’s a continuous effort to build financial trust into the software at every layer.

Below is a clear view of what today’s fintech platforms require in a highly regulated, fast-moving U.S. market.

Users engage with an interface, but financial systems connect with everything underneath it. Banks, payment processors, identity providers, and risk engines all rely on the stability of your backend. That means your software has to perform like a financial platform from its earliest version.

Teams building in fintech focus on:

This is the foundation that makes a fintech product trustworthy. The UX simply reveals the strength of the platform behind it.

In the U.S., compliance frameworks directly influence software architecture. Every workflow touching money, identity, or records has regulatory weight and the platform needs to support that from the start.

Key compliance domains include:

These aren’t “later additions.” They guide design decisions across onboarding, transactions, lending logic, payouts, and any action that requires verification or monitoring. Strong fintech platforms treat compliance as part of the core system, not a parallel function.

Fintech software relies heavily on partner integrations like identity, banking, payments, fraud tools, data aggregators, and card issuers. The success of your product often depends on how cleanly and reliably you interact with them.

A strong API-first approach includes:

Because the U.S. financial ecosystem is fragmented, API-first development gives teams the flexibility to work with multiple providers while keeping the platform predictable.

Fraud activity in the U.S. has increased sharply, and every fintech platform is under constant pressure to detect, prevent, and respond to suspicious behavior. This reality affects almost every part of the system.

Key areas influenced by risk include:

Risk management has become part of the core architecture. Modern fintech systems treat fraud as an ongoing, high-volume data challenge rather than a reactive security problem.

American users adopt financial products that feel fast, transparent, and easy to understand. Any hesitation like unclear steps, slow responses, or unnecessary friction, directly affects conversion and retention.

Strong fintech UX emphasizes:

The interface should make users feel in control, while the platform handles the complex financial operations that enable that confidence.

Fintech platforms often experience rapid growth once they hit product-market fit. The software must be ready for increased load, rising transaction volumes, and expanding regulatory requirements long before that moment arrives.

Scalable platforms support:

When growth comes, the system should be ready to absorb it without sacrificing reliability or trust.

If you take a step back and observe how Americans interact with money today, you’ll notice something subtle but important: financial behavior is fragmenting. People earn in one place, move money through another, borrow using a third, invest using a fourth and expect each touchpoint to feel seamless.

This fragmentation is exactly why the US fintech market moves so quickly. Every gap becomes an opportunity, every friction becomes a product, and every industry, from logistics to healthcare, is rethinking what role financial services play inside their platforms.

Below is a look at the actual product momentum inside the US fintech landscape, focusing on the forces shaping what teams are choosing to build right now.

Today’s financial tools are being shaped by people who refuse to wait. Creators, gig workers, merchants, freelancers, and small businesses all want immediate access to the money they’ve already earned.

This demand is driving the development of:

Borrowing behavior in the US has changed dramatically. People want clarity, not complexity and businesses want tools that can evaluate risk faster without sacrificing accuracy.

This shift has led to products built around:

Instead of traditional scorecards, these systems pull signals from income patterns, spending behavior, and risk models turning lending into a more dynamic and equitable product.

The new wave of US investors isn’t waiting for retirement, they’re actively seeking financial growth now. They prefer digital platforms that deliver clarity, automation, and planning tools without requiring financial expertise.

This is creating demand for:

Unlike older wealth tools, these platforms are built around simplicity, transparency, and mobility, allowing users to take control of their financial future without hidden complexity.

Many of the financial tools consumers use daily aren’t banks but they provide bank-like features because Banking-as-a-Service unlocks licensed capabilities through modular components.

Teams are building:

But as regulatory attention increases, BaaS development now requires airtight processes around data access, reporting, transaction accuracy, and sponsor bank alignment.

Some of the most innovative fintech ideas today come from companies that aren’t fintech companies at all. Financial services are appearing inside the platforms people already use:

This category is expanding because financial services become more valuable when they’re contextual, not separate.

Insurance has always moved at a slower pace than the rest of financial services. People are used to fast payments, instant approvals, and clear interfaces everywhere else, so waiting days for a quote or chasing down a claims update feels outdated. That gap has pushed a lot of new Insurtech products into the market.

Teams are putting their energy into things like:

The common thread: people want insurance to feel less like paperwork and more like a normal digital service.

Most people have money flowing in and out of several places like bank accounts, cards, apps, subscriptions, side income, you name it. It’s easy to lose track. That’s why PFM apps keep growing: people want one place that tells them what’s happening with their money without making them dig for it.

Some of the products showing up here include:

PFM works because it removes the mental clutter around day-to-day finances.

Running a small business means dealing with invoices, payments, receipts, contractors, payroll, and everything in between often by yourself. Traditional accounting software feels too heavy for the pace small businesses move at, so newer tools are filling in the gaps.

Products here usually focus on:

These tools stick because they take stress off the owner and give them a clearer picture of their business without extra work.

Taxes and bookkeeping tend to sit on the “I’ll deal with it later” list until later becomes a problem. With multiple income streams becoming more common, people want tools that help them stay on top of it throughout the year, not just in April.

This has led to products such as:

These tools are picking up momentum because they make taxes feel manageable rather than intimidating.

In the US market, fintech platforms don’t compete on features anymore.

They compete on capabilities, the invisible machinery beneath the interface that determines whether your platform feels instant, secure, and reliable or fragile, slow, and untrustworthy.

These capabilities rarely appear on pitch decks, yet they shape everything from conversion to compliance to investor confidence. And you can tell almost immediately whether a fintech product has them by how it behaves under pressure.

Let’s break down what truly differentiates a high-performing fintech platform as the underlying principles that dictate its real-world performance.

The strongest fintech platforms don’t “verify identity” they understand identity.

They look at device behavior, network signals, past patterns, micro-interactions, and even typing cadence to determine whether a user should move forward, slow down, or be quietly flagged. This silent intelligence is what allows legitimate customers to glide through onboarding while preventing fraud without resorting to heavy-handed friction.

In a market where synthetic identities are growing rapidly, identity intelligence becomes a competitive moat, not a compliance requirement.

Money movement is where fintech platforms reveal who they truly are.

A strong platform settles payouts accurately even when volumes spike, reconciles ledgers down to the cent, and communicates status updates with absolute clarity. A weak one leaves users refreshing screens, opening tickets, and wondering whether their funds are floating in limbo.

In the US market, where real-time rails are emerging and merchants expect instant settlement, platforms succeed only if their transaction engine behaves like a seasoned accountant and a high-frequency trading system at the same time.

Fraud isn’t an event; it’s an ecosystem.

The platforms that stay ahead aren’t reacting, they’re predicting. They identify new fraud patterns through behavior clusters, geolocation mismatch, IP velocity, disposable email patterns, or mule account networks long before a human analyst sees them.

This predictive defense becomes part of the platform’s rhythm.

When fraudsters evolve, the system evolves faster

In fintech, compliance is a backbone.

High-performing platforms don’t interpret regulations at the end of a build. They translate them into architectural rules from day one. This means every workflow - onboarding, payout, dispute, withdrawal, reporting - carries compliance logic as naturally as it carries business logic.

Platforms that treat compliance as paperwork struggle.

Platforms that treat compliance as engineering scale.

Every fintech product depends on external partners like banks, processors, networks, KYC vendors, fraud engines, and data providers. And every one of these partners will fail occasionally.

The difference between a resilient platform and a brittle one is not whether integrations fail but what happens next.

A strong platform reroutes transactions, queues requests, retries intelligently, and informs users with clarity. A weak one breaks silently, loses data, or leaves teams scrambling to diagnose a chain reaction they never anticipated.

Data is not stored, it is streamed, evaluated, correlated, and fed back into the system.

The US fintech products that scale aren’t the ones that have dashboards; they’re the ones that make decisions, instant risk judgments, predictive credit insights, automated compliance checks, and anomaly alerts without waiting for humans to intervene.

This “operational intelligence” defines modern fintech more than the UI ever will.

Fintech users don’t expect magic.

They expect certainty.

A payment should show status.

A withdrawal should feel resolved.

A failed action should offer a path forward.

A freeze or review should be communicated with empathy.

When a fintech platform behaves predictably, users trust it.

When it behaves inconsistently, even once, users leave.

If there’s one truth about fintech architecture, it’s this: nothing works unless everything works. Payments, identity checks, fraud monitoring, compliance logic, data flows, partner APIs… they all fire at the same time. So the architecture behind a fintech platform can’t be improvised. It has to be deliberate, clean and ready for the kind of pressure only financial systems experience.

Think of this section as the “under-the-hood” tour. Nothing too technical. Just the essentials you need to understand what makes a fintech platform stable and scalable.

Fintech traffic never behaves the same way two days in a row. That’s why most mature platforms break the system into small services instead of one massive block.

One service handles identity. Another handles the ledger. Another handles payouts.

Why this matters:

If payouts spike on a Monday morning, only the payout service scales.

If a single service misbehaves, the entire platform doesn’t go down with it.

It’s cleaner, safer and much easier for teams to maintain without risking downtime.

Finance only works when boundaries are clear.

Your account logic shouldn’t touch your risk logic.

Your ledger shouldn’t share responsibilities with identity verification.

Domain Driven Design is simply a way of respecting those boundaries.

Each financial domain has its own rules and its own data.

Nothing leaks. Nothing gets confused.

It sounds obvious, but you’d be surprised how many problems disappear when each domain stays in its lane.

Fintech is fast. Users expect actions to happen right away.

If someone sends money, checks their balance or triggers a security step, the system needs to react immediately.

Event driven processing makes that possible.

Instead of waiting for batch jobs, every important action becomes an event that the right service listens to.

It keeps the platform responsive and helps maintain accuracy even when thousands of things are happening every second.

Fraud detection, credit scoring and limit management don’t work well if the system is always “catching up.”

Fintech needs fresh data, not yesterday’s data.

Real time pipelines move information through the platform as soon as it’s created.

If suspicious behavior appears, the system sees it instantly.

If a customer’s activity changes, the risk engine adjusts in real time.

This is how modern fintech products stay one step ahead instead of constantly reacting.

Every fintech platform needs strong partner connections:

banks, processors, card networks, KYC tools, compliance vendors and more.

An API first approach makes sure all these connections are reliable and consistent.

One standard, predictable way to talk to partners.

Clear fallback behavior when something slows down.

No messy logic sprinkled across the codebase.

This matters a lot more once you expand into new regions or add new financial features.

In fintech, you can’t fix what you can’t see.

Observability tools show how the platform behaves in real time.

Resilience patterns keep the system steady when partners fail or traffic spikes.

Zero trust ensures every internal request is authenticated, which is essential when handling sensitive account data.

Together, these practices help teams respond quickly, catch issues early and maintain overall system health.

Fintech products earn trust through clarity and predictable behavior. When money is involved, users don’t want surprises. They want to understand what’s happening, why it’s happening, and how long it will take. These simple expectations shape the entire UX for modern financial products in the US market.

Keep the steps users feel to a minimum and let the system handle the rest. Some friction is required for compliance, but it should never feel like unnecessary effort. Show only what matters and keep everything else silent in the background.

People want to know immediately if something worked. Approvals, transfers, verification, password updates, every action should give fast, clear feedback. If something needs time, say so in plain language. Uncertainty creates distrust faster than failure.

Fintech serves users with different abilities, financial knowledge and comfort levels. Straightforward text, clean layouts, assistive navigation and guidance for complex actions make the product usable for more people. Good accessibility builds confidence.

Most quick tasks happen on mobile, but review and planning often move to desktop. The experience should feel consistent across both. Keep mobile flows fast and simple, while giving desktop room for deeper actions like statements, reviews and analysis.

People trust products that explain what data is collected and why. Clear permission screens and simple explanations work better than long disclaimers. Transparency reduces hesitation and improves completion rates.

Building a fintech product in the US isn’t cheap or simple, and that’s not a bad thing. You’re dealing with money, regulations, user trust and multiple external partners. The key is understanding what actually drives cost, what a realistic timeline looks like and how to choose a team that won’t cut corners or bury you in rework later.

Here’s the real, practical view.

Fintech isn’t priced like normal app development. The bulk of the effort goes into the parts users never see. Costs tend to rise or fall based on how deep your platform goes into financial logic.

A few things that consistently move the budget:

If any team gives you a fixed number without asking detailed questions about these areas, they’re guessing.

Fintech timelines vary, but there’s a general rhythm most builds follow. If everything is clear and approvals move smoothly, you can move quickly. If banking partners or compliance teams take longer, the timeline shifts. That’s normal.

The typical flow looks like this:

The goal isn’t to rush. It’s to launch something stable that won’t collapse under real usage.

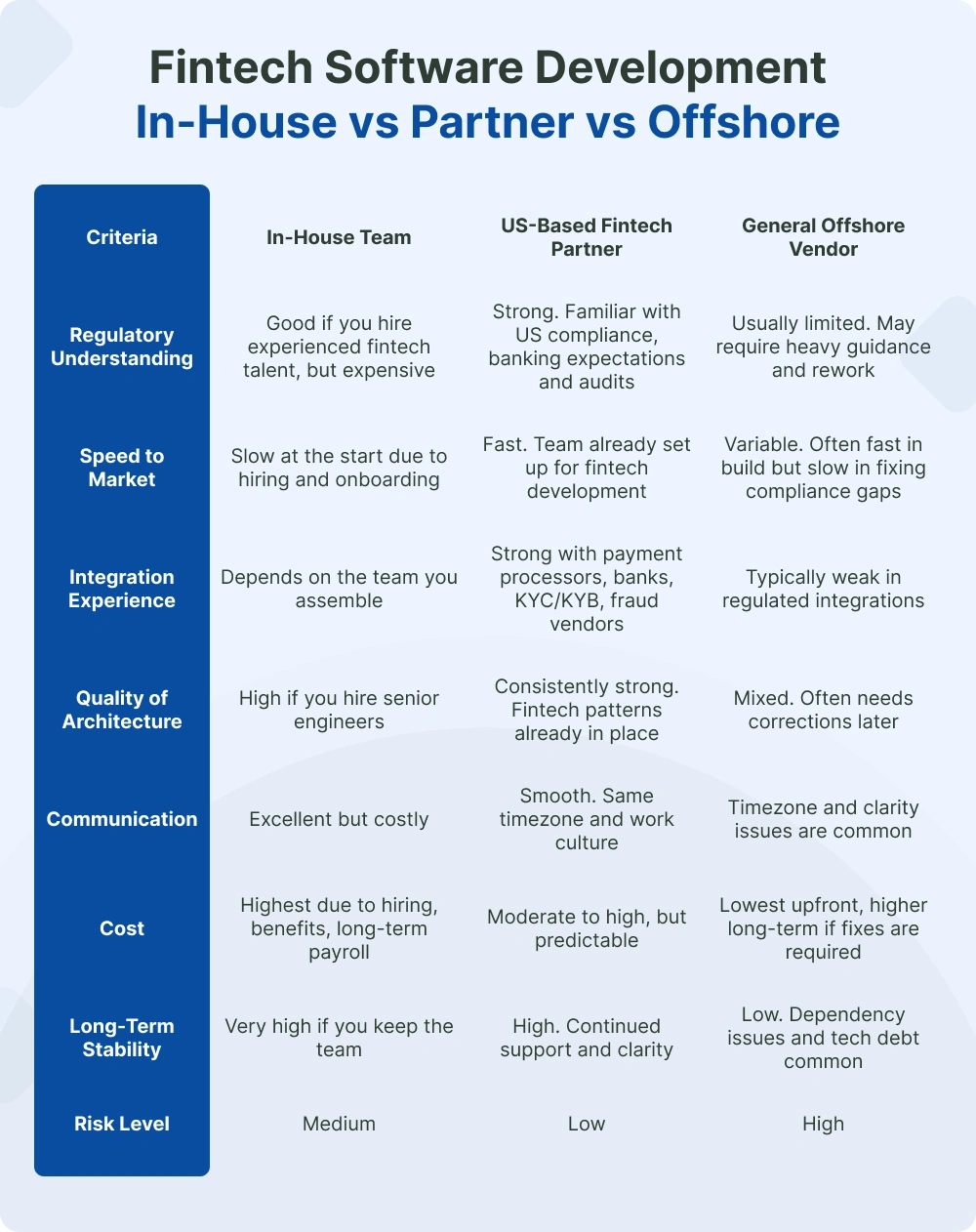

A team that’s actually worked inside the US fintech ecosystem understands the environment you’re stepping into. That means fewer surprises and fewer long email chains explaining regulatory details.

A strong US based partner usually understands:

Being in the same timezone also solves half the communication pain during high-pressure releases.

You can tell very quickly whether a partner knows fintech or just builds apps. Ask them how they handle financial data, how they structure a ledger, how they monitor transactions or how they plan integrations. Their clarity will tell you everything.

A reliable fintech partner should be able to explain how they:

If their answers stay at the surface level, they’re not the right fit.

Compliance is the part of fintech nobody sees, but everyone feels. When it’s done right, the product feels trustworthy and smooth. When it’s done poorly, everything feels slow, confusing or risky. That’s why US fintech teams treat compliance as core infrastructure, not an afterthought.

KYC, AML, PCI and SOC 2 aren’t just checkboxes. They shape how onboarding works, how transactions flow and how sensitive data is stored. The strongest products build these rules directly into their systems so the experience stays clean while the guardrails stay solid.

Risk management follows the same philosophy. Fraudsters aren’t waiting for batch jobs, so platforms can’t either. Real-time decisioning has become the standard. Login anomalies, rapid spending shifts, unusual device behavior, the system must interpret these signals instantly and act before a real issue forms.

Security ties everything together. Zero-trust inside the platform, strict access control, encrypted data paths and continuous monitoring keep the product stable even during unpredictable spikes. Users don’t need to know the details, but they can feel when a product handles security seriously.

Strong infrastructure is becoming the real differentiator, with teams investing more in ledgers, integrations, and backend reliability than in flashy UI.

Some fintech platforms become popular because they’re loud. Others become essential because they quietly power the financial experiences people use every day. The companies below fall into the second group. They’re trusted, widely adopted, and play a real role in how money moves around the world whether users realize it or not.

Stripe earned its reputation by making payments feel less like a headache and more like a solved problem. Developers like it because it gets out of the way. Businesses like it because it works anywhere, scales easily, and handles everything from billing to fraud protection. At this point, Stripe isn’t just a tool, it’s the default for online payments.

If you’ve ever connected a bank account to an app, there’s a good chance Plaid did the heavy lifting. It bridges the messy world of banking data and the cleaner world of modern apps. Teams rely on Plaid because it’s consistent, dependable, and saves them from building dozens of one-off integrations.

Adyen is the platform big global brands lean on when they want one payment system that works everywhere. Instead of juggling multiple processors across different countries, they run everything through Adyen. It’s stable, enterprise-friendly, and built for companies that can’t afford downtime.

Fiserv is one of the quiet giants of the financial world. Banks, lenders, processors and payment networks rely on it to keep their systems running. You won’t see it trending on social media, but you will see it behind a huge portion of the financial infrastructure people use every day. It’s the definition of dependable.

Square made it easy for local businesses, solo merchants, food trucks, salons and freelancers to accept payments and manage their finances without needing ten different tools. The hardware is simple, the software is even simpler, and everything just works together. For millions of small businesses, Square is their financial system.

Fintech teams work with us because they want products that feel steady, clean and built for the long run. We’ve helped platforms pass compliance reviews, handle real-time traffic, reduce fraud exposure and streamline complex integrations. More importantly, we help founders avoid the mistakes that force expensive rebuilds later.

Our approach is practical. We care about the architecture, the data flows, the invisible trust signals and the pieces most teams don’t think about until it’s too late. Whether you're building payments, lending, wealth, or embedded finance, we help you bring structure and predictability to a space that moves fast.

In this episode, We simplify what goes into creating a fintech platform: essential features, smart compliance, real-time capabilities, and clean architecture. You’ll also learn the factors affecting development cost and the trends every US fintech team should watch.

Fintech moves quickly, and getting it right from the start makes all the difference.

If you need a team that understands US regulations, modern architecture and real-world product demands, VT Netzwelt is here to support you.

Reach out when you’re ready to start.

Are You Prepared for Digital Transformation?

Software Development

Ready to build smarter real estate tech? Discover how PropTech software can boost efficiency, streamline workflows, and meet U.S. market demands. Let’s get started!

Software Development

The healthcare industry has plenty of software, but much of it adds complexity instead of value. Key issues include poor integration, clinician burnout from inefficient systems, and rising patient demand for digital care. With IT spending growing, the focus must shift to solutions that reduce manual effort, fit into real workflows, and improve outcomes. This […]

Software Development

In today’s digital economy, software developers aren’t just code writers — they’re architects of innovation, scalability, and business growth. But hiring the right developer isn’t just about “how much it costs.” It’s about what that cost means for your product, your timeline, and your long-term ROI.